A Template for a Simple Budget

How much do you spend a month?

Ok, now what’s the real answer?

Despite all the new technology and services that are available now, most people have no idea what they spend each month. In fact, recent studies show that sixty-one percent of US adults do not monitor their budget.

I think this comes down to lack of knowledge and probably just some fear of seeing what the number might be. There are a lot of finance apps that do a great job, though I think there is something even simpler just to be sure there is no delay.

A simple start to budgeting

I have a suggestion that can be done quick and free for most people.

If you have an iPhone, iPad or Mac than you have access to the spreadsheet app from Apple called Numbers.

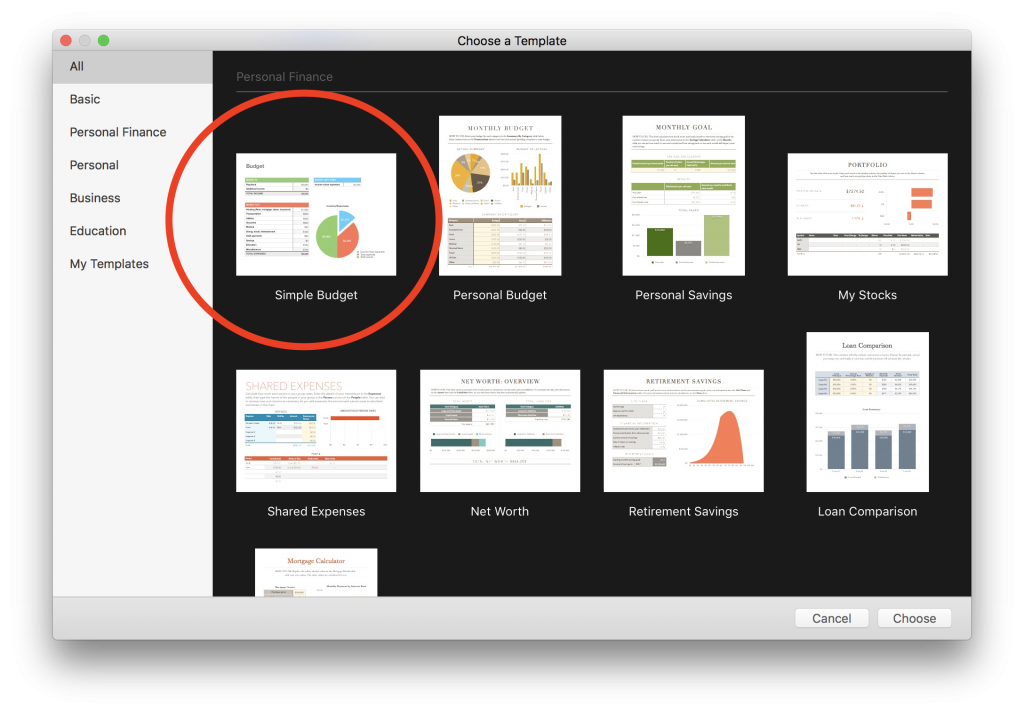

Open up the app on any Apple device, scroll down and and start a new document using the “Simple Budget” template.

When the template opens it will give you a place to put your income called “Money In” and a place for your expenses called “Money Out.”

As seen below, the spreadsheet will start with some default categories and numbers. Delete those numbers and put in your own.

Remember that if you pay a bill yearly (like car registration) to divide that number by twelve and enter it as a monthly expense.

The important step

One of the nice things about Numbers is that it’s easy to share a document with another person. You just need to tap the collaborate button. I think the sharing of this document is key, and something not easily done in apps.

If you are married, share it with your spouse and ask them to add any expenses and dollar amounts that they can remember. Once done, consider showing it to your kids for a teaching opportunity.

If you are single, consider sharing it with a friend or relative that you trust. They might be able to add categories that you’ve forgotten, or may even be able to recommend ways to save if they see high numbers.

If you have teenage kids, ask them to fill out the categories on what they think they’ll need in college or living on their own. It’s a great education tool.

Conclusion

I like this exercise because it’s simple and easy. You aren’t signing up for any services or wondering how your data will be sold. It’s just a real way to see where you are at financially, and offers some feedback from someone you trust.

And once you’ve seen the numbers, you might find that it influences your decisions day to day.